Step by Step Setting of e-Way Bill in Tally.ERP 9

Effective from 1st April 2018, all registered dealers need to generate e-Way Bill for the movement of goods if the total of taxable value and tax amount in the invoice exceeds Rs. 50,000.

- Open the company.

- Click on F11:Features > F3 :Statutory.

- Enable Goods and Services Tax (GST) – Yes .

- Set/alter GST details – Yes .

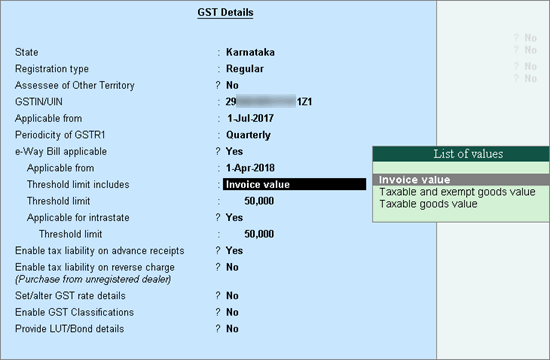

- In the Company GST Details screen, e-Way Bill options, including the applicable date, threshold limit, and the value to be considered for the threshold limit, are provided.

- Select the value to be considered for the threshold limit based on your business requirement. As below image show.

Note: Ladakh is listed in the State field in Release 6.5.5 and later versions

You can enable the option e-Way Bill applicable for intrastate? and enter the Threshold limit , based on the applicability of e-Way Bill for your state. The threshold limit will be applied for the transactions recorded from Tally.ERP9 Release 6.4.6.

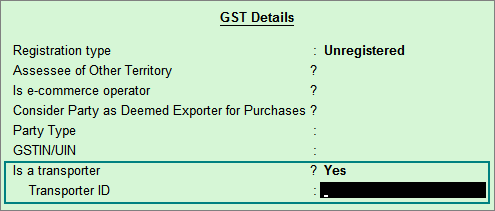

In the party ledger, if you have selected the Registration type as:

● Regular or Composition : The GSTIN/UIN is considered as the transporter ID.

● Unknown or Unregistered : Enter the 15-digit Transporter ID

If the transporter ID is incorrect, the message appears as shown:

- How to Activating Tally.ERP 9 Step by Step

- How to Install Tally.ERP 9

- Top 10 Tally.ERP 9 Shortcuts key

- How to Setup e-Way Bill In Tally.ERP 9

- How to Activate GST in Tally | Enable GST in Tally. ERP

- How to Create a Company In Tally.ERP 9 | Tally me company Kaise Banaye

- How To Update Company Details | Alter Company | Delete Company